31+ Home mortgage payoff calculator

31 44220 18914921426779404 10736432460242781 100 11736432460242781. One-time payoff due to home selling.

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

Credit card payoff calculator.

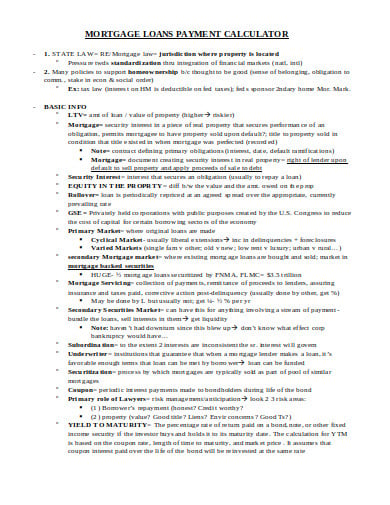

. Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years Additional Months 0 mont. 2836 are historical mortgage industry standers which are. Early mortgage payoff calculator is.

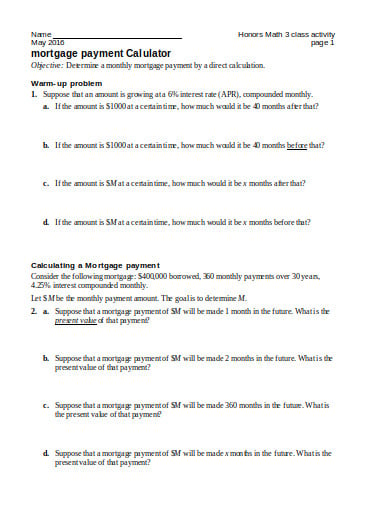

Once the user inputs the required information the Mortgage Payoff Calculator will calculate the pertinent data. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. More payments on the principal of the loan equate to assets earning interest at the same rate as the interest rate on the loan.

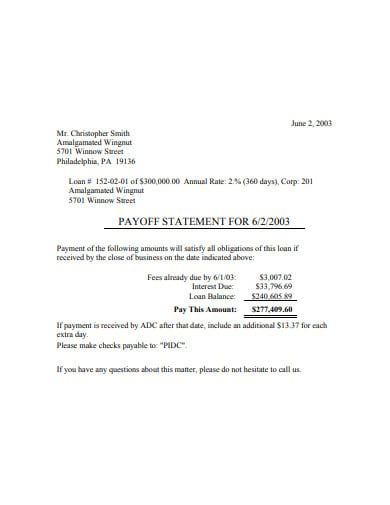

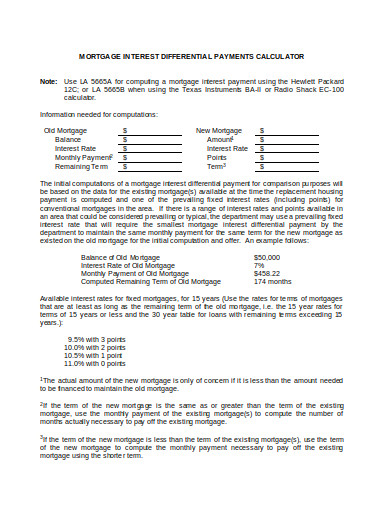

A mortgage payoff statement itemizes the amounts required to fully satisfy all obligations secured by the loan that is the subject of the payoff. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. In January 2009 the average 30-year fixed mortgage rate dropped by 106 percentage points from 2008.

Assuming you have a 20 down payment 30000 your total mortgage on a 150000 home would be 120000. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Todays average rate on a 30-year fixed mortgage is 603 up 011 from the previous week.

Upfront mortgage insurance premium. This method gives the property owner a home free and clear of debt. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 539 monthly payment.

The Federal Reserve has raised interest rates in 2022 to combat inflation and. Home Equity Home Equity. Making payments on your student loans can seem endless.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Borrowers may be able to save on interest costs by going with a 15-year fixed mortgage as they. Choosing a 15-year fixed home loan is advantageous if you can afford the shorter payment period.

15 Year vs 30 Year Loans. Home prices have continued to surge despite higher mortgage rates and an increase in housing supplyfactors that typically put downward pressure on home prices. All FHA loans require the borrower to pay two mortgage insurance premiums.

Use this calculator to get an idea of when your loan payoff date will beand ways to make that date not so far away afterall. Mortgage rates had dropped lower in 2012 when one week in November averaged 331 percent. Improving Your Financial Profile.

Home Loan Amortization Calculator. The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. A mortgage refinance allows you to replace an existing mortgage with a new one.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. And with high interest rates the day you finally pay off your debt might be farther away than you think. In order to get a complete amortization schedule we need to repeat steps 1 - 4 for the whole payment term until the mortgage is paid off.

You will get a comparison table that compares your original mortgage with the early payoff. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. You can even withdraw some of the value youve amassed in the home the equity and use it for renovations or anything else.

Aside from selling the home to pay off the mortgage some borrowers may want to pay off their mortgage earlier to save on interest. Remaining Balance Current Balance - Monthly Principal Payment Step 5 - Repeat steps 1 - 4 until the mortgage is the payoff Steps 1 - 4 calculate only the first month of an amortization table. But the numbers still show the.

Payoff Early Mortgage Calculator - If you want to pay off your mortgage earlier. It also assumes you wont use the card to make any new purchases. We offer an advanced mortgage payment calculator to figure monthhly housing expenses.

Mortgage home loans amortization Description. The loan is secured on the borrowers property through a process. Your 1098 will be available in Statements and Documents no later than January 31.

The Benefits and Disadvantages of a 15-Year Fixed Mortgage. Recession in December 2007 to June 2009. Simple Mortgage Calculator - The advanced mortgage calculator with a down payment is designed to be a home mortgage calculator with many options that are applied to home.

How rising mortgage rates affect home equity loans. But some of 2012 was higher and the entire year averaged out at 365 for a 30-year mortgage. Learn About Home Refinancing.

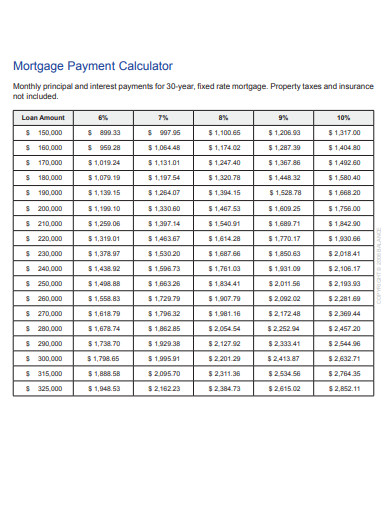

This debt payoff calculator can help give you a sense of timing and monthly payments as you put together a repayment plan but it doesnt consider other factors such as your cards annual fee if it has one late-payment fees or any other fees you might incur. This calculator will compute a mortgages monthly payment amount based on the principal amount borrowed the length of the loan and the annual interest rate. Borrowers have a variety of options for paying off home loans prior to the maturity date.

Down payment home location credit score term ARM options are available for selection in the filters area at the top of the table. According to historical accounts the mortgage crisis aggravated the US. Home Equity Loan Payoff.

It increased to 509 percent in 2010 but went down to 477 percent in. Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoffLoan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff. The refinance can result in lower monthly payments a reduced interest rate or a shorter payoff term.

This calculator will also compute your total mortgage payment which will include your property tax property insurance and PMI payments. 175 percent of the loan amount paid when the borrower gets the loan. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender.

Microsoft Excel Mortgage Calculator With Extra Payments Subject. Web-ready Excel template to calculate montly mortgage payments with amortization schedule and extra payments.

Coming Soon 5883 Carlson Street Shoreview Mn 55126 Mls 6168458 Themlsonline Com In 2022 Home Mortgage Construction Loans Mortgage Lenders

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

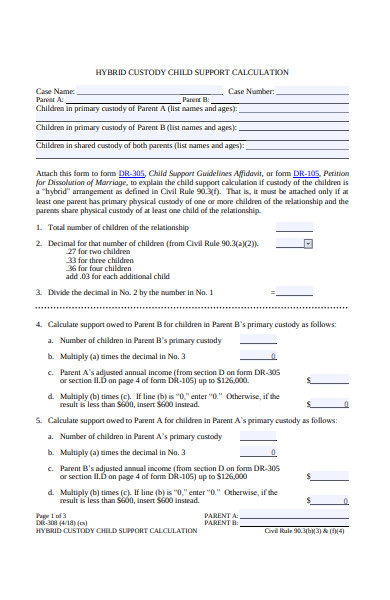

Free 31 Calculation Forms In Pdf Ms Word

How To Pay Off Debt Fast Myhomeanswers

13 Payoff Statement Templates In Pdf Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Free 9 Sample Lease Payment Calculator Templates In Excel

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Free 37 Loan Agreement Forms In Pdf Ms Word

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

Free 9 Sample Lease Payment Calculator Templates In Excel

Free 9 Sample Lease Payment Calculator Templates In Excel

Free 9 Sample Lease Payment Calculator Templates In Excel

Free 9 Sample Lease Payment Calculator Templates In Excel