Required minimum distribution 2021 calculator

Discover The Answers You Need Here. If you turned 72 prior to January 1 2022 you must take your 2022 RMD before December 31 2022.

Where Are Those New Rmd Tables For 2022

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from.

. Ad The IRS Requires You Withdraw an Annual Minimum Amount From Certain Retirement Accounts. You reached age 72 on July 1 2021. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Required minimum distribution Calculate your earnings and more The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your. Ad Register and Subscribe Now to work on IRS IRA Required Minimum Distribution Worksheet.

Distributions are Required to Start When You Turn a Certain Age. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Distribute using Table I.

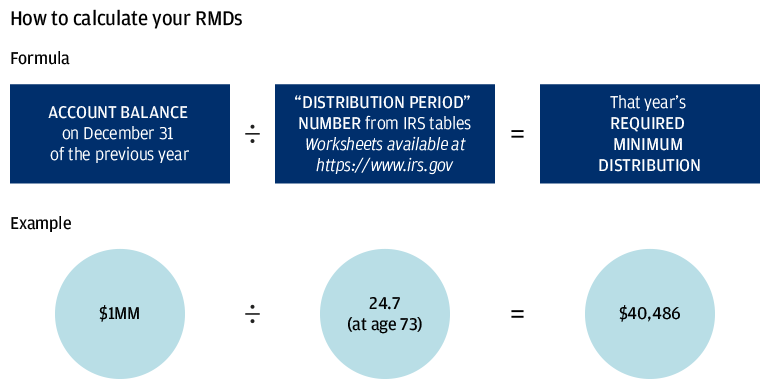

IRA Required Minimum Distribution Worksheet Use this worksheet for 2021 Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your. How is my RMD calculated. An RMD is the minimum amount of money you must withdraw from a tax-deferred retirement plan and pay ordinary income.

Use this calculator to determine your Required Minimum Distribution RMD. Determine beneficiarys age at year-end following year of owners. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Required minimum distributions RMDs are amounts that US. What Is a Required Minimum Distribution RMD. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

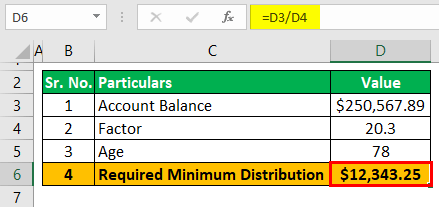

Once the factor is determined it can be divided into the December 31 2020 balance to get the RMD amount for 2021. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. IRA Required Minimum Distribution RMD Table for 2022.

This calculator helps people figure out their required minimum distribution RMD to help them. The distribution period or life expectancy also decreases each year so your RMDs will. As a reminder if your first RMD was required in 2021 and you havent already taken it.

Retirees who are age 72 or above are required by the IRS to take a minimum distrubtion annually. We will automatically calculate your distribution to help ensure your RMD is taken each year avoiding potential additional taxes. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you reach 72.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. Account balance as of December 31 2021 7000000 Life expectancy factor. Maya inherited an IRA from her mother.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. Your Required Minimum Distribution this year is 0 How is my RMD calculated. The service also helps ensure that you do not over- or under.

You can also explore your IRA beneficiary withdrawal options based on. Therefore Joe must take out at least 495050 this year 100000 divided by 202. Our Resources Can Help You Decide Between Taxable Vs.

Tax law requires one to withdraw annually from traditional IRAs and employer-sponsored retirement plans. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705.

Rmd Calculator Required Minimum Distributions Calculator

How To Calculate Rmds Forbes Advisor

2022 New Irs Required Minimum Distribution Rmd Tables

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

New Guidelines For Your Required Minimum Distributions Rmd Coming In 2022 Paul R Ried Financial Group Llc

Required Minimum Distribution Calculator Estimate The Minimum Amount

Irs Letter 5759c Required Minimum Distribution Not Taken H R Block

Why Taking Rmds On Time Is So Important J P Morgan Private Bank

Required Minimum Distribution Calculator Estimate The Minimum Amount

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Required Minimum Distributions Rmds Youtube

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Required Minimum Distribution Calculator Estimate The Minimum Amount

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts